7 Bookkeeping Mistakes That Are Costing You Money (And How Your EA Can Help Fix Them)

- Heather De Jesus

- Nov 21, 2025

- 5 min read

Running a small business is tough enough without losing money to avoidable bookkeeping mistakes. Yet every day, business owners unknowingly throw away thousands of dollars due to simple errors in their financial records. The good news? These mistakes are totally fixable, and an Enrolled Agent (EA) can help you avoid them from the start.

Let's dive into the seven most expensive bookkeeping mistakes and see how professional help can save your bottom line.

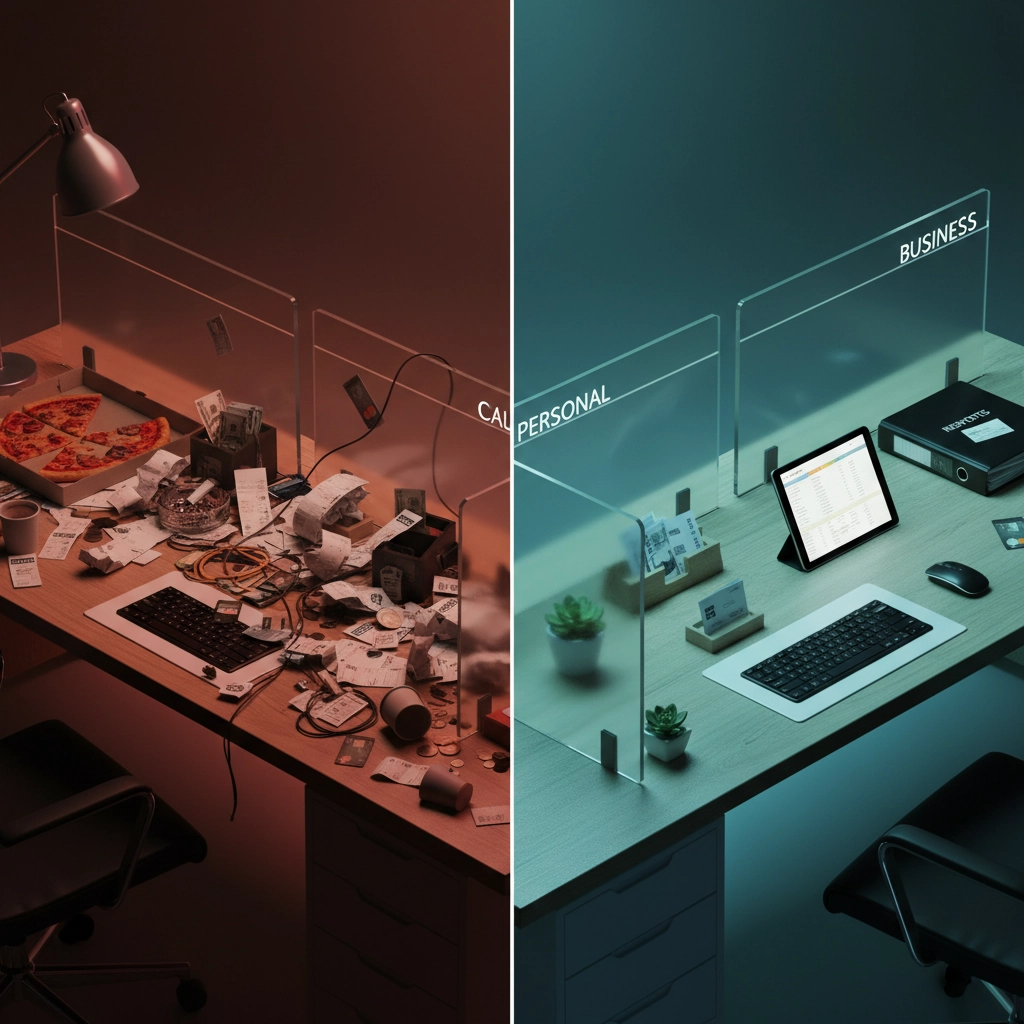

1. Mixing Personal and Business Finances

This is the big one – and probably the most expensive mistake you can make. When you use your personal bank account or credit card for business expenses, you create a bookkeeping nightmare that costs you in multiple ways.

First, you'll spend hours (or pay someone else to spend hours) sorting through transactions to separate business from personal expenses. Second, you'll likely miss legitimate business deductions because they're buried in your personal spending. Third, if the IRS comes knocking, mixed finances make you look unprofessional and can trigger deeper scrutiny.

How an EA helps: An Enrolled Agent can set you up with proper business accounts from day one and create clear protocols for keeping your finances separate. If you've already mixed things up, they can help untangle the mess and get you back on track.

2. Losing Track of Receipts and Documentation

That $15 lunch receipt might seem insignificant, but when you multiply small purchases over a year, you're looking at hundreds or thousands of dollars in lost deductions. Without proper documentation, the IRS won't allow these deductions – even if they're 100% legitimate business expenses.

The problem gets worse when you realize that some business owners lose 20-30% of their potential deductions simply because they can't find the paperwork to back them up.

How an EA helps: An EA can set up a systematic receipt tracking process that actually works for your lifestyle. They'll also help you understand which receipts are most critical and establish backup documentation methods for when receipts go missing.

3. Skipping Regular Account Reconciliation

When you don't reconcile your accounts regularly, your books stop reflecting reality. You might think you have $5,000 in the bank when you actually have $3,000 – and that kind of miscalculation can lead to bounced checks, overdraft fees, and serious cash flow problems.

Even worse, errors compound over time. A $200 mistake in January becomes much harder to find and fix in December when it's buried under 11 months of additional transactions.

How an EA helps: An EA will implement a regular reconciliation schedule and catch discrepancies before they become major problems. They'll also teach you (or your team) how to maintain accurate records between professional reviews.

4. Double-Entering Transactions (Or Missing Them Completely)

Here's a common scenario: You take a client out for dinner and record the $80 expense when you pay the restaurant. Then, when you pay your credit card bill, you accidentally record that same $80 again. Now your expenses are overstated by $80, which throws off your entire financial picture.

On the flip side, missing transactions entirely means you're not claiming deductions you deserve, and your financial reports don't accurately show your business performance.

How an EA helps: An EA can establish systems to prevent duplicate entries and ensure every legitimate business transaction gets recorded exactly once. They'll also conduct regular reviews to catch any transactions that slip through the cracks.

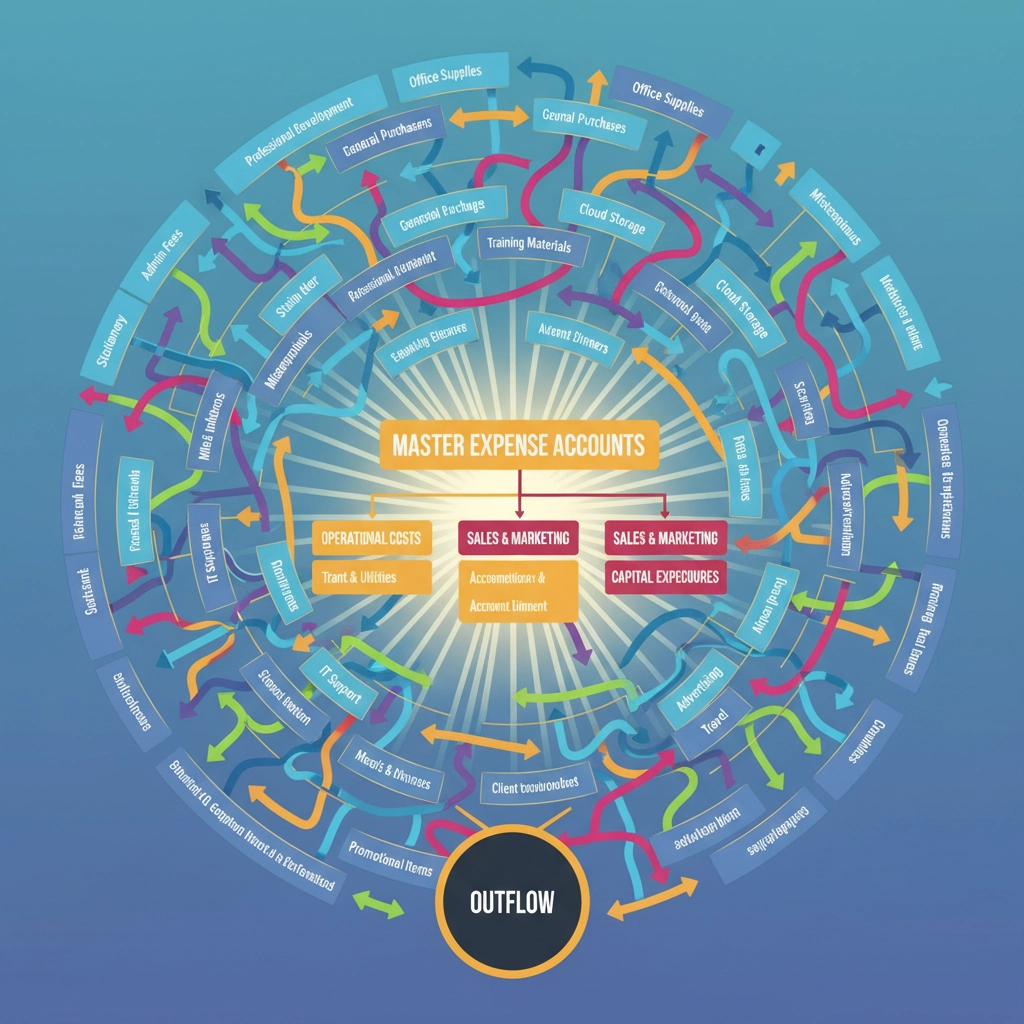

5. Messy Chart of Accounts and Expense Misclassification

Many business owners create their own chart of accounts without understanding proper bookkeeping categories. The result? Multiple categories for similar expenses, unclear financial reports, and confusion about where money is actually going.

For example, you might have separate categories for "Office Supplies," "Business Supplies," and "General Supplies" when they should all be consolidated. This makes it impossible to see your true spending patterns and can lead to poor business decisions.

How an EA helps: An EA will create a clean, standardized chart of accounts that follows professional bookkeeping guidelines. They'll ensure all transactions are properly categorized, giving you clear insights into your business finances.

6. Sticking with Manual Accounting Systems

If you're still tracking expenses in spreadsheets or keeping paper records, you're costing yourself time and money. Manual systems are error-prone, time-consuming, and make it nearly impossible to get real-time insights into your business finances.

Plus, manual systems make tax preparation much more expensive because your accountant has to spend extra time organizing and inputting your data.

How an EA helps: An EA can recommend and help implement accounting software that fits your business size and needs. They'll also provide training to ensure you're using the system effectively.

7. Missing Out on Deductions You Deserve

This might be the most expensive mistake of all. Business owners often miss deductions for:

Business mileage (which can add up to thousands of dollars annually)

Home office expenses

Professional development and training

Business meals and entertainment

Equipment depreciation

The IRS allows these deductions, but many business owners either don't know about them or don't track the necessary information to claim them.

How an EA helps: An EA knows the tax code inside and out. They'll identify deductions you're missing and establish tracking systems to ensure you capture every legitimate business expense going forward.

The Real Cost of DIY Bookkeeping Mistakes

Let's put this in perspective. A typical small business might lose:

$2,000-5,000 annually in missed deductions

$500-1,500 in unnecessary penalties and fees

50-100 hours of time fixing errors that could have been prevented

When you factor in the opportunity cost of that time (what else could you have been doing to grow your business?), the total cost easily reaches $10,000 or more per year.

How an Enrolled Agent Saves You Money

An Enrolled Agent is a tax professional licensed by the IRS to represent taxpayers. Unlike a general bookkeeper, EAs have specialized training in tax law and can help you navigate complex situations.

Working with an EA typically saves money in several ways:

Prevention is cheaper than correction: It costs much less to set up proper systems from the beginning than to fix years of messy records later.

Maximized deductions: An EA knows every deduction you're entitled to and will ensure you're not leaving money on the table.

Audit protection: If the IRS comes calling, an EA can represent you and help resolve issues quickly and professionally.

Time savings: Instead of spending your evenings and weekends on bookkeeping, you can focus on growing your business.

Peace of mind: Knowing your books are accurate and compliant lets you sleep better at night.

Getting Started

If you recognize your business in any of these mistakes, don't panic. The important thing is to address these issues before they get worse. Start by evaluating your current bookkeeping processes and identifying which mistakes might be costing you money.

Consider scheduling a consultation with an Enrolled Agent to discuss your specific situation. Many EAs offer initial consultations where they can review your current setup and provide recommendations for improvement.

Remember, good bookkeeping isn't just about tax compliance – it's about understanding your business finances so you can make informed decisions that drive growth and profitability. When you fix these seven mistakes, you're not just saving money; you're setting your business up for long-term success.

The cost of professional help is almost always less than the cost of these mistakes. Your future self (and your bank account) will thank you for making the investment in proper bookkeeping practices now.

Comments